Investment in property for rental income is good?

Deciding whether to invest in property for rental income depends on various factors, including your financial goals, risk tolerance, market conditions, and personal circumstances. Here are some considerations to help you make an informed decision:

- Rental Yield: Evaluate the potential rental yield of the property, which is the annual rental income generated as a percentage of the property’s purchase price. Compare rental yields with other investment options to assess the income potential.

- Market Demand: Research the rental demand in the locality where you plan to invest. Factors such as job opportunities, educational institutions, infrastructure development, and population growth can influence rental demand and occupancy rates.

- Property Location: Choose a location with high rental demand, good connectivity, proximity to essential amenities (schools, hospitals, shopping centers), and potential for capital appreciation over time.

- Property Type: Consider the type of property that is in demand for rental purposes, such as residential apartments, single-family homes, student housing, or commercial properties. Analyze market trends and tenant preferences to select the most suitable property type.

- Rental Market Dynamics: Understand the rental market dynamics, including rental rates, vacancy rates, tenant demographics, and rental trends. Conduct thorough market research to assess the potential rental income and occupancy stability.

- Investment Goals: Determine your investment goals and financial objectives. Investing in rental properties can provide a steady stream of passive income, diversify your investment portfolio, hedge against inflation, and build long-term wealth through property appreciation.

- Cash Flow Analysis: Perform a cash flow analysis to estimate the net rental income after accounting for expenses such as property maintenance, repairs, property management fees, property taxes, insurance, and vacancy losses. Ensure that the rental income covers all expenses and generates positive cash flow.

- Risk Management: Assess the risks associated with property investment, including tenant default, property damage, market volatility, interest rate fluctuations, and regulatory changes. Implement risk mitigation strategies to safeguard your investment and minimize potential losses.

- Liquidity and Capital Growth: Consider the liquidity and capital growth potential of the investment. While rental properties offer steady income, they may have lower liquidity compared to other investments such as stocks or bonds. Evaluate the long-term capital appreciation potential of the property.

- Tax Implications: Understand the tax implications of rental income, including income tax on rental earnings, deductions for property expenses, capital gains tax on property sale, and compliance with local tax regulations. Consult with a tax advisor to optimize your tax strategy.

Ultimately, the decision to invest in property for rental income should align with your investment objectives, risk profile, and financial circumstances. Conduct thorough research, seek professional advice, and carefully evaluate the potential risks and rewards before making any investment decisions.

How to invest in property in india overseas checklist

Investing in property in India from overseas involves several steps and considerations. Here’s a checklist to guide you through the process:

- Research and Due Diligence:

- Research the Indian real estate market, including property trends, demand-supply dynamics, and potential investment locations.

- Conduct due diligence on the legal, regulatory, and tax aspects of property ownership in India, including foreign investment regulations and tax implications.

- Define Investment Objectives:

- Determine your investment goals, such as rental income, capital appreciation, or long-term wealth accumulation.

- Establish a budget and identify the type of property (residential, commercial, land, etc.) that aligns with your investment objectives.

- Engage Legal and Financial Advisors:

- Seek advice from legal and financial advisors familiar with cross-border property investments and Indian regulations.

- Understand the legal framework, documentation requirements, and tax implications associated with property investment in India.

- Open NRE/NRO Bank Account:

- Open a Non-Resident External (NRE) or Non-Resident Ordinary (NRO) bank account in India to facilitate financial transactions related to property investment.

- NRE accounts are repatriable, allowing you to transfer funds freely, while NRO accounts are non-repatriable, with certain restrictions on fund repatriation.

- Obtain PAN Card and Aadhaar Card:

- Apply for a Permanent Account Number (PAN) and Aadhaar Card in India, as they are essential for financial transactions, tax compliance, and property ownership.

- Identify Investment Opportunities:

- Explore property listings, developer projects, and investment opportunities in desired locations through online platforms, real estate agents, or property exhibitions.

- Property Inspection and Due Diligence:

- Conduct physical inspections or virtual tours of shortlisted properties to assess their condition, location, amenities, and potential for rental income or capital appreciation.

- Verify property ownership, title documents, land records, approvals, and encumbrances through legal due diligence.

- Negotiate Purchase Terms:

- Negotiate the purchase price, payment schedule, and other terms and conditions with the seller or developer based on your due diligence and market analysis.

- Draft and Review Sale Agreement:

- Prepare or review the sale agreement or builder-buyer agreement to ensure that it accurately reflects the negotiated terms, payment milestones, possession date, and other relevant clauses.

- Execute Power of Attorney (POA):

- If you cannot be physically present in India for property transactions, consider executing a Power of Attorney (POA) appointing a trusted representative to act on your behalf.

- Complete Financial Transactions:

- Transfer funds from your overseas bank account to your NRE/NRO account in India to facilitate property payments, including the purchase price, stamp duty, registration fees, and other charges.

- Register Property Deed:

- Register the property deed or sale agreement with the local Sub-Registrar of Assurances to legally transfer ownership rights and establish your title over the property.

- Comply with Tax Obligations:

- Fulfill tax obligations in India, including payment of stamp duty, registration fees, property tax, and compliance with income tax regulations on rental income or capital gains.

- Manage Property and Investment:

- Arrange for property management services, tenant selection, rent collection, and maintenance to ensure the smooth operation and optimal returns from your investment.

- Stay Informed and Monitor Investment:

- Stay updated on market trends, regulatory changes, and economic developments that may impact your property investment in India.

- Regularly monitor your investment performance, track rental income, property appreciation, and expenses to assess the overall return on investment (ROI).

By following this checklist and seeking professional guidance, you can navigate the process of investing in property in India from overseas effectively and maximize your returns while complying with legal and regulatory requirements.

How can I send a power of attorney from abroad to sell property in India?

To send a Power of Attorney (POA) from abroad to sell property in India, follow these steps:

- Draft the Power of Attorney: Prepare a Power of Attorney document clearly outlining the powers granted to the attorney-in-fact (the person you authorize to act on your behalf) to sell the property in India. Ensure that the document complies with Indian laws and includes all necessary details, such as property details, your identification, and the attorney-in-fact’s details.

- Notarization: Get the Power of Attorney document notarized by a notary public or a competent authority in the country where you are residing. This step ensures that the document is legally valid and authenticated.

- Attestation by Indian Embassy/Consulate: Take the notarized Power of Attorney document to the nearest Indian Embassy or Consulate in your country. Request them to attest the document to verify its authenticity and validity. This step is essential for legal recognition of the POA in India.

- Stamp Duty: Check the stamp duty requirements for the Power of Attorney document in India. Some states may require the POA to be stamped as per the Stamp Act. Pay the applicable stamp duty either online or through an authorized bank.

- Sending the POA to India: Once the Power of Attorney document is notarized, attested by the Indian Embassy/Consulate, and stamped (if required), send the original document to your authorized representative or attorney-in-fact in India through a reliable courier service.

- Receipt by the Attorney-in-fact: Ensure that the attorney-in-fact receives the original Power of Attorney document in India. They may need to present the document to relevant authorities, such as the Sub-Registrar of Assurances, during the property sale process.

- Registration in India (Optional): While registration of the Power of Attorney document is not mandatory for its validity, it is advisable to register the POA at the office of the Sub-Registrar of Assurances in the jurisdiction where the property is located. This provides additional legal authenticity and protection.

- Proceed with Property Sale: Once the attorney-in-fact receives the POA and completes any necessary registration formalities, they can proceed with the sale of the property on your behalf as per the terms outlined in the Power of Attorney document.

It’s essential to seek legal advice from a qualified lawyer familiar with Indian property laws to ensure that the Power of Attorney document complies with all legal requirements and facilitates a smooth property sale process in India.

Process of selling a property in India?

The process of selling a property in India typically involves the following steps:

- Property Valuation: The seller gets the property valued by a professional valuer or real estate agent to determine its market worth.

- Documentation Check: The seller gathers all relevant documents related to the property, including title deeds, sale deed, property tax receipts, building plan approvals, NOCs (No Objection Certificates), and any other legal documents.

- Preparation of Sale Agreement: The seller and the buyer negotiate the terms and conditions of the sale, including the sale price, payment schedule, possession date, and other relevant clauses. A sale agreement is prepared, outlining these terms and signed by both parties.

- Due Diligence by Buyer: The buyer conducts due diligence on the property, which may involve verifying the title, checking for any encumbrances or legal issues, and ensuring all necessary approvals are in place.

- Obtaining No Objection Certificates (NOCs): The seller obtains NOCs from relevant authorities, such as the society or local municipal corporation, confirming there are no outstanding dues or objections against the property.

- Execution of Sale Deed: Once the due diligence is completed and all necessary approvals and NOCs are obtained, the parties proceed to execute the sale deed. This involves signing the deed in the presence of witnesses and registering it with the local Sub-Registrar of Assurances.

- Payment of Stamp Duty and Registration Fees: The buyer pays the stamp duty and registration fees applicable to the sale deed as per the local laws and regulations.

- Handover of Possession: After the sale deed is executed and all payments are made, the seller hands over possession of the property to the buyer as per the agreed-upon possession date.

- Transfer of Ownership: The buyer becomes the legal owner of the property upon registration of the sale deed in their name. The seller provides all original documents and keys to the buyer.

- Post-sale Formalities: The seller notifies relevant authorities, such as the local municipal corporation, society, and utility service providers, about the change in ownership. Any outstanding dues or bills are settled, and the property is transferred to the buyer’s name for property tax and other purposes.

It’s essential for both the seller and the buyer to engage legal professionals, such as real estate lawyers or property consultants, to ensure a smooth and legally compliant transaction. Additionally, understanding local regulations and compliance requirements is crucial for a successful property sale in India.

What is the platform used for a real estate property listing in India?

In India, there are several platforms used for real estate property listings. Some of the most popular ones include:

- Magicbricks: Magicbricks is one of India’s largest online real estate platforms, offering property listings, buying, selling, and renting services across residential and commercial properties.

- 99acres: 99acres is another prominent online real estate portal in India, providing property listings, search options, and comprehensive property information for buyers, sellers, and renters.

- Housing.com: Housing.com offers a wide range of property listings, along with features such as verified listings, neighborhood insights, and advanced search options to help users find their ideal property.

- CommonFloor: CommonFloor is an online real estate platform that offers property listings, search tools, and neighborhood insights, catering to both residential and commercial property seekers.

- PropTiger: PropTiger provides property listings, expert advice, and personalized services to buyers, sellers, and investors in the real estate market.

- NoBroker: NoBroker is a platform that connects property owners directly with potential buyers or tenants, eliminating the need for brokers or middlemen in the process.

- Makaan.com: Makaan.com offers property listings, buying, selling, and renting services, along with neighborhood insights and expert advice for users in the Indian real estate market.

- Square Yards: Square Yards is a technology-enabled real estate platform offering property listings, advisory services, and transaction support to buyers, sellers, and investors.

- Sulekha Property: Sulekha Property provides property listings and related services across different cities in India.

- Facebook Marketplace OLX: While not dedicated exclusively to real estate, these online classified platforms are commonly used by individuals and agents to list properties for sale or rent in India.

- OLX: While not dedicated exclusively to real estate, these online classified platforms are commonly used by individuals and agents to list properties for sale or rent in India.

- Quicker: While not dedicated exclusively to real estate, these online classified platforms are commonly used by individuals and agents to list properties for sale or rent in India.

- Homeonline:

- Realestateindia:

These platforms serve as valuable resources for individuals and businesses looking to buy, sell, or rent properties across India, providing a convenient and comprehensive online marketplace for real estate transactions.

Indore Top Builders and Colony

- Omaxe Limited

- DLF Limited

- Mirchandani Group

- Apollo Creations

- Ansal Housing

- DCNPL Pvt. Ltd.

- Aarone Group

- Sarthak Estate Developers

- Mangal Murti Developers

- Shri Vallabh Developers

- Suncity Projects

- Silver Spring Developers

- Vastushodh Projects

- Shubh Labh Infrahome

- Vrindavan Builders & Developers

- Radhika Builders

- Paraspar City Developers

- Akriti Homes Pvt. Ltd.

- Balaji Construction

- Skyline Construction Co.

- Palazzo Group

- Mangal City Developers

- Kalyan Developers

- Man Developments

- Sakar Group

- Royal Developers

- DCNPL Pvt. Ltd.

- Aarone Group

- Aarone Group

- Sarthak Estate Developers

- Mangal Murti Developers

- Shri Vallabh Developers

- Suncity Projects

- Silver Spring Developers

- Vastushodh Projects

- Shubh Labh Infrahome

- Vrindavan Builders & Developers

- Radhika Builders

- Paraspar City Developers

- Akriti Homes Pvt. Ltd.

- Balaji Construction

- Skyline Construction Co.

- Palazzo Group

- Mangal City Developers

- Kalyan Developers

- Man Developments

- Sakar Group

- Royal Developers

- DCNPL Pvt. Ltd.

- Aarone Group

- Sahaj Homes

- Silver Realities

- Dainik Homes

- Kuber Builders

- Dreamland Builders

- Vedant Developers

- Shree Nakoda Builders

- RK Group

- Shri Sai Developers

- Pristine Group

- Surya Group

- Siddhivinayak Developers

- Vardhman Developers

- Parthivi Developers

- Star Developers

- Sun City Infra

- Balaji Group

- Ganesh Builders

- Raj Builders and Developers

- Sagar Group

- Shriji Builders

- Divya Developers

- Shikhar Developers

- Visionary Group

- Rajat Builders

- Pratham Infra

- Shivam Developers

- Mohan Developers

- Samarth Group

- Neelkanth Builders

- Pragati Developers

- Pinnacle Group

- Aryaman Developers

- Nexus Developers

- Amrapali Group

- Divyam Developers

- Maxworth Group

- Shriram Builders

- Saket Builders

- Prime Developers

- Panache Builders

- Shree Ram Builders

- Shubhankar Builders

- Urban Infrastructure

- Dhruv Developers

- Swastik Developers

- Horizon Group

- Samruddhi Builders

- Dream City Builders

- Skyline Builders

- Spacevision Group

- Tricone Projects India Ltd.

- Morya Infrastructure Pvt. Ltd.

- Agarwal Group

- SNG Group

- Dolphin Developers

- Horizon Shelters

- Goyal and Co. Construction Pvt. Ltd.

- Sarthak Builders

- Aadinath Realty

- Fortune Builders and Developers

- Shri Krishna Developers

- Ashoka Developers and Builders Ltd.

- Samrajya Builders

- Crown Group

- Lemon Developers

- Shreenath Builders

- Silver Space Developers

- GRM Infra

- Fortune Builders and Developers

- Asnani Group

- Rajendra Nagar Developers

- Viraaj Developers

- Sankalp Group

- Aryan Infrastructure

- Narmada Infrastructure Pvt. Ltd.

- Harshdeep Construction

- Prithvi Group

- Premshree Builders and Developers

- Space Time Network

- Malwa Group

- Prestige Group

- Sheetal Infrastructure

- V Square Group

- Keya Homes Pvt. Ltd.

- Yashoda Infra Developers

- Guman Group

- Morya Group

- Amrit Homes

- Aarav Group

- Labdhi Lifestyle Limited

- Royal Infra

- Paras Land Developers Pvt. Ltd.

- SDC Group

- Solitaire Developers

- Sigma Realty

- Leo Infra

- Abhinav Group

- Silver Spring Developers

- Reliable Developer

- Silicon Group

- Sumit Woods Limited

- City Corporation Ltd.

- Kothari Builders and Developers

- Cosmos Group

- Arvind Infrastructure

- Maheshwari Group

- Shree Tirupati Group

- Agarwal Group

- Rama Group

- Pinnacle Group

- Avant Group

- Minal Builders

- Bhoomi Group

- Indore Development Authority (IDA)

- Agarwal Construction Co.

- Bapat Builders

- Crossroad Builders

- Girnar Group

- Crown Realities

- Shri Siddhivinayak Developers

- Tirth Realities

- Tulsi Construction

- Aastha Builders and Developers

- Anantnath Developers

- Asian Realty

- Chandan Group

- Cresent Group

- Cynosure Group

- Essar Group

- Gagan Developers

- Kalyan Developers

- Laxmi Developers

- Om Developers

- Royal Group

- Sumeet Group

- Swastik Group

- Unique Group

- Vishal Group

- Zed Plus Group

- Shree Krishna Group

- Shriram Group

- Sobhagya Developers

- SPS Group

- Trinity Group

- Unique Dream Builders

- Arihant Constructions

- Kushwaha Group

- Kritan Group

- Man Developments

Places to visit Near Ujjain

Certainly! Ujjain, a city rich in history and spirituality, is surrounded by several notable attractions that offer diverse experiences. Here are some places you might consider visiting near Ujjain:

- Mahakaleshwar Jyotirlinga Temple: This ancient Hindu temple dedicated to Lord Shiva is one of the twelve Jyotirlingas and is the most famous attraction in Ujjain itself.

- Kal Bhairav Temple: Situated near the Mahakaleshwar Temple, this temple is dedicated to Kal Bhairav, a fierce manifestation of Lord Shiva. It’s known for its unique rituals and is believed to be a guardian of the city.

- Ram Ghat: Located on the banks of the Shipra River, Ram Ghat is a sacred bathing ghat where devotees gather to take a dip in the holy waters, especially during the Kumbh Mela.

- Harsiddhi Temple: This temple is dedicated to the goddess Harsiddhi, considered one of the Siddh Peethas. It’s believed that visiting this temple fulfills one’s wishes.

- Sandipani Ashram: According to Hindu mythology, this is the place where Lord Krishna and Sudama received their education from Guru Sandipani. It’s located around 10 kilometers from Ujjain.

- Bhartrihari Caves: Situated atop the Ratlam Kothi, these caves are believed to have been the meditation spot of the renowned poet-saint Bhartrihari. The caves offer panoramic views of the city.

- Vedh Shala (Observatory): Built by Maharaja Jai Singh II of Jaipur, this observatory is similar to the Jantar Mantar in Jaipur. It houses several astronomical instruments and is of historical significance.

- Kaliadeh Palace and Observatory: Located on the outskirts of Ujjain, this site is associated with the famous astronomer-king Maharaja Jai Singh II. The palace and observatory offer beautiful views of the surroundings.

- Chintaman Ganesh Temple: Situated around 10 kilometers from Ujjain, this temple dedicated to Lord Ganesha is believed to fulfill the desires of its devotees.

Places to Visit near Indore

Indore, located in the heart of Madhya Pradesh, India, offers a range of nearby attractions for travelers to explore. Here are some places you might want to visit:

- Mandu: Known for its historical significance and architectural marvels, Mandu is around 98 kilometers from Indore. It boasts of stunning palaces, forts, and monuments like Jahaz Mahal, Hindola Mahal, and Rupmati’s Pavilion.

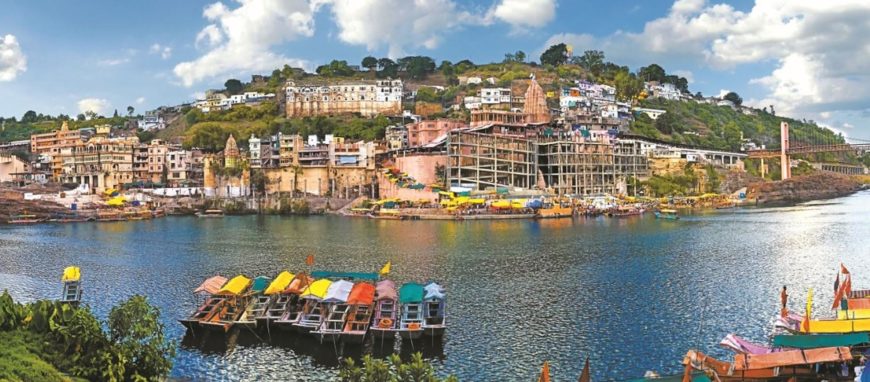

- Omkareshwar: Situated around 77 kilometers from Indore, Omkareshwar is a sacred Hindu pilgrimage site known for its Jyotirlinga temple dedicated to Lord Shiva. It’s located on an island in the Narmada River and offers scenic beauty along with religious significance.

- Ujjain: A major Hindu pilgrimage destination, Ujjain is approximately 55 kilometers from Indore. It’s famous for the Mahakaleshwar Temple, one of the twelve Jyotirlingas in India, and the Kumbh Mela that happens every twelve years.

- Patalpani Waterfall: This picturesque waterfall is about 36 kilometers from Indore and offers a refreshing retreat into nature. It’s particularly popular during the monsoon season when the waterfall is at its fullest.

- Ralamandal Wildlife Sanctuary: Located just 15 kilometers from Indore, Ralamandal Wildlife Sanctuary is a haven for nature lovers and wildlife enthusiasts. It’s home to a variety of flora and fauna, including deer, monkeys, and various bird species.

- Janapav Kuti: Situated around 45 kilometers from Indore, Janapav Kuti is a scenic spot surrounded by hills and forests. It’s believed to be the birthplace of Lord Parshuram and offers trekking opportunities along with panoramic views of the surrounding landscapes.

- Choral Dam: About 40 kilometers from Indore, Choral Dam is a popular picnic spot offering serene surroundings and water-based activities like boating and fishing.

- Rajwada: In the heart of Indore lies Rajwada, the historical palace of the Holkar dynasty. It’s a blend of Maratha, Mughal, and French architectural styles and serves as a symbol of the city’s rich cultural heritage.

Super Corridor Indore

The Indore Super Corridor is a significant infrastructure project located in the city of Indore, in the Indian state of Madhya Pradesh. It’s a 12,300-acre (5,000-hectare) development project aimed at creating a modern and sustainable urban corridor.

Here are some key features and aspects of the Indore Super Corridor:

- Location: The corridor is situated on the outskirts of Indore, connecting the city with nearby towns and villages. It is strategically located to promote economic growth and development in the region.

- Infrastructure: The project involves the development of world-class infrastructure, including wide roads, modern transportation facilities, utilities, and green spaces. The goal is to create a well-planned and integrated urban environment.

- Economic Development: The Indore Super Corridor is expected to boost economic development in the region by attracting investments, industries, and businesses. It provides opportunities for commercial, residential, and industrial development, thus creating employment and enhancing the quality of life for residents.

- Smart City Features: The corridor incorporates smart city principles and technologies to improve efficiency, sustainability, and quality of life. This includes the use of ICT (Information and Communication Technology) solutions for governance, infrastructure management, and public services.

- Education and Healthcare: The project includes provisions for educational institutions, healthcare facilities, and other social infrastructure to support the growing population in the area.

- Environmental Sustainability: Efforts are made to ensure that the development is environmentally sustainable, with measures for greenery, water conservation, waste management, and renewable energy integration.

- Connectivity: The corridor aims to improve connectivity within the region and beyond. It includes provisions for road connectivity, with wide and well-planned roads to accommodate the increasing traffic flow. Additionally, the project may also involve the development of mass transit systems such as bus rapid transit (BRT) or metro rail to enhance public transportation options.

- Industrial and Commercial Zones: One of the key objectives of the Indore Super Corridor is to attract industrial and commercial activities. Special economic zones (SEZs) or industrial parks may be established within the corridor to encourage investment and facilitate industrial growth. These zones could focus on specific sectors such as IT, manufacturing, or biotechnology.

- Residential Development: Alongside industrial and commercial zones, the corridor may include planned residential areas to accommodate the growing population. These residential developments could range from affordable housing projects to high-end residential complexes, providing a range of housing options for different income groups.

- Mixed-Use Development: The Indore Super Corridor may incorporate mixed-use developments, combining residential, commercial, and recreational spaces within the same area. This mixed-use approach aims to create vibrant and livable neighborhoods where residents can live, work, and socialize in close proximity.

- Public Amenities: To enhance the quality of life for residents, the corridor may include various public amenities such as parks, recreational facilities, shopping centers, healthcare facilities, schools, and community centers. These amenities contribute to creating a well-rounded and sustainable urban environment.

- Public-Private Partnerships (PPPs): The development of the Indore Super Corridor may involve collaboration between the government and private sector stakeholders through PPPs. This partnership model enables leveraging the expertise and resources of both sectors to achieve the project’s objectives effectively.

Overall, the Indore Super Corridor represents a holistic approach to urban development, integrating infrastructure, economic growth, environmental sustainability, and social well-being to create a dynamic and prosperous urban corridor in the region.